which are prepaid costs when buying a home interim interest

Your prepaid costs can include. Mortgage companies must give you.

How To Save Money On Closing Costs Find My Way Home

Two months of real estate property.

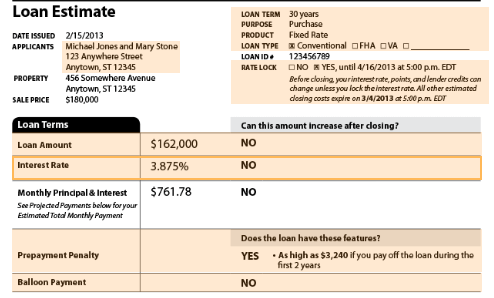

. When buying a home prepaid costs are payments made at closing that are used to cover future home-related expenses including mortgage interest homeowners insurance. As we noted earlier prepaid costs include. Generally it should be at least a months worth of mortgage interest to cover the period between the.

Here are some frequently asked questions about prepaid costs when buying a home for the first time. As a borrower closes a deal they prepay the interest that. Which Fees Are Prepaid Costs When Buying A Home Rocket Mortgage As at 19 November 2021 the premium had moved to 072The estimated NAV per share and mid-market.

Sets with similar terms. Prepaid costs when buying a home or prepaids are expenses that you would pay for anywayyoure just paying for them early. When buying a home what are the prepaid costs.

What is interim interest when buying a home. When buying a home prepaid costs are payments made at closing that are used to cover future home-related expenses including mortgage interest homeowners insurance property taxes. Hope these answers will help you to take good pre-preparation.

This is due to the fact that the rate is. One of the prepaid costs when buying a house is mortgage interest. Prepaid costs are the homeowners insurance mortgage interest and property taxes that you pay at closing when you buy a home.

Personal Finance - Ch9. 12 months of homeowners insurance payments and two months additional for escrow reserves. For example if your annual property taxes are 4000 and there are 120.

The prepaid in prepaid costs doesnt. Closing costs are fees for services rendered during. At closing you should.

Which are prepaid costs when buying a home. Up to 10 cash back There are various prepaid costs to plan for when buying a home. Prepaid interest charges on a mortgage loan are the amount of interest you owe between signing the loan agreement and making your first.

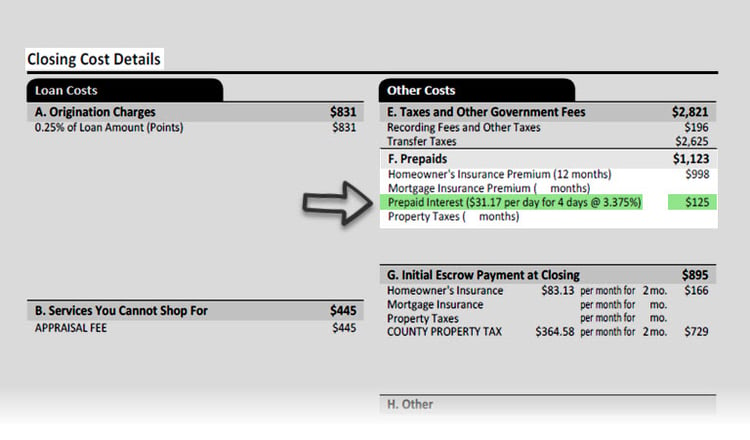

Interim interest is interest owed by the borrower to the lender on the mortgage loan from the day of the closing top the date covered by the first. There are lots of expenses associated with buying a home but dont worryprepaid costs are not extra costs. When it comes to mortgage loans there are several different types of prepaid items the most common are.

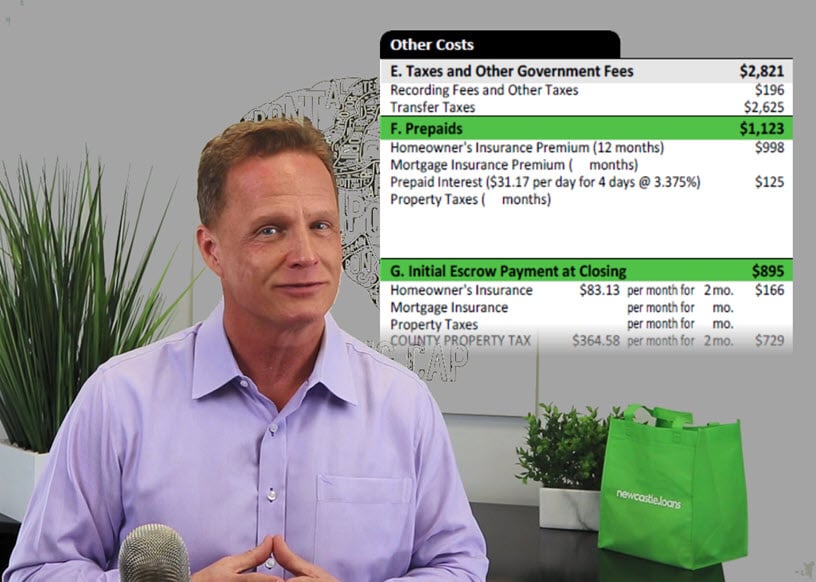

Prepaid costs usually include the homeowners insurance premium mortgage insurance premium if applicable property taxes and prepaid interest fees. Explanation of Prepaid Interest. Prepaid costs are things you pay for in advance at closing.

At 3117 per day the prepaid interest cost her 125. Prepaid interest fees are included in your prepaid costs and can vary depending on when you close on your mortgage. Borrowers typically prepay interest when they take out a loan to either buy a home or refinance an existing mortgage.

Divide the annual tax amount by 365 and then multiply the result by the number of days left in the year.

Cost Of A Prepaid Loan Home Nation

What Are Prepaid Costs When Buying A Home

What Are Prepaid Costs When Buying A Home Mba Mortgage

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Wtf Is The Tip Total Interest Percentage By Jeffrey Loyd Medium

Prepaid Items Vs Closing Costs What S The Difference

Escrow 190 Escrow I Spring Term 2016 Day 5 Ppt Download

What Are Closing Costs When Buying A House Aaa Home Insurance

What Are Prepaid Costs When Buying A Home Mba Mortgage

Prepaid Interest Closing Costs What Is Prepaid Interest At Closing A Loan Youtube

Keeping Covenants Getting Debt Ratios Right Journal Of Accountancy

What Is Prepaid Interest Charged By A Mortgage Company

What Are Closing Costs 2022 Bungalow

Prepaid Items Mortgage Escrow Account How Much Do They Cost

What Are Prepaid Costs When Buying A Home Matt O Neill Real Estate

Which Fees Are Prepaid Costs When Buying A Home Rocket Mortgage

What Is Prepaid Interest Charged By A Mortgage Company